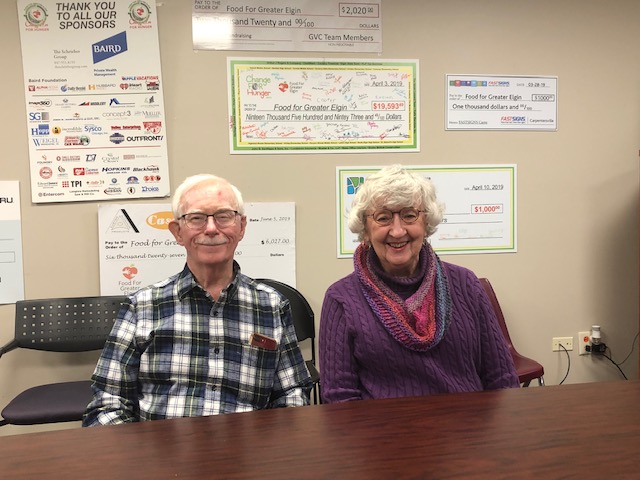

In October, Russell Buckardt came up to me during the First Presbyterian Church Martin Luther King food drive, wanting to fill me in on a gift from the church, the Buckardts, and their IRA.

Pam and Russell are at the age where they are required to take a minimum payout from their IRA. Their financial advisor said they could take the money and pay taxes on it, or give it directly to charity, tax-free. This is called a Qualified Charitable Distribution and is given by a donor who is 70 ½ or older, paid directly from the IRA to the charity. If your required minimum distribution is $10,000, you can give $10,000 and not pay taxes on the income. Which started their thinking…

Pam and Russ have been long-time supporters of Food for Greater Elgin, never extravagant givers, but consistent supporters. Russ vividly remembers sitting at an Elgin Cooperative Ministry meeting and hearing Rev. James Marks of Bethesda Church of God in Christ tell the group, “I have a dream of a food pantry that is big enough to feed everybody in need.” The church worked hard to bring that reality.

And Pam and Russ? Giving from their IRA was simple:

- First, they spoke with their financial advisor to know what forms to prepare.

- Second, they met with their advisor to share which charities they wanted to support, and discover how much they had to give. The only limitation under the law is that the charity must be a 501(c)3 recognized charity. Pam and Russ made a choice, signed a form, and FFGE received a check!

The Buckardts liked giving in this way. It was ‘tax smart’ but, as Pam insisted, it was never just that: It supported Food for Greater Elgin’s mission of providing food to people in need that counted.

Would you like to include FFGE in your year-end giving? You can donate to our campaign, or ask your advisor/accountant about tax-smart giving through your IRA!